Pebble Finance helps passive investors avoid climate unfriendly companies when building their investment portfolios.

Index funds are a popular investment method, allowing investors to save time in the investing process. An index fund is a common type of mutual fund that tracks returns on a market index which measures the performance of a number of stocks. Index funds are also a passive investment strategy, which often means lower costs for investors. They allow for diversification of one’s portfolio and are often lower risk, making them popular among passive investors. Some popular index funds include Schwab S&P 500, Vanguard S&P 500 ETF, and Shelton NASDAQ-100 Index District.

One alternative to traditional index funds is direct indexing. Direct indexing is the act of buying individual components of an index, rather than buying them pre-packaged from a broker or investment advisor[1]. With recent technological advancements, direct indexing is both more fiscally responsible, simpler, and quicker.

Direct indexing:

- Allows investors to skip the middleman, saving more money.

- Does not include any trading fees.

- Diversifies one’s portfolio.

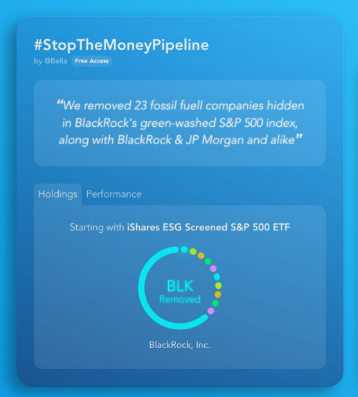

From a sustainability perspective, conventional index funds often do not account for corporate responsibility or the environment. The number of ESG funds has exploded in recent years: it’s estimated that there are now over 550 funds in the U.S. alone[2]. Unfortunately, many “ESG-Screened” versions of index funds tend to be costly, and still contain a great deal of fossil fuel or other less sustainable companies. This makes it difficult for those who want to earn a passive income from investing, but also have a level of respect and care for the environment. The lack of investment options can be troubling for folks who want to support their values through investing.

Pebble Finance, using the concept of direct indexing, grants users the ability to pick and choose the companies that comprise their index funds. Pebble is a technology-based alternative to investing with conventional index funds. By allowing users to personalize their investments, users can in turn, divest from companies that don’t align with their values on the individual level. For example, Pebble allows individuals to exclude fossil-fuel corporations from their portfolios, makes investing more sustainable.

How does it work? A user first enters his/her personal preferences into the app. The software will filter through companies in the S&P 500 and eliminate those that do not align with the user’s values. In the case that users expand and want to invest outside of the S&P 500, they will be charged a standard fee. Pebble helps users create values-aligned portfolios, connect to a broker, and invest in companies that have the planet in mind. They currently work with Alpaca, which is a commission-free stock trading platform.

At a broader level, the company aims to change the way that ESG ratings and portfolios are created and applied. Pebble believes that communities should define set their own ESG standards since sustainability standards are not one-size-fits-all. Pebble is working on a new feature to help groups identify and apply ESG scores at a local level - a key step in defining sustainability standards and subsequently forming a more resilient system. The company is also working on ways that ambassadors can extend these ratings and specifically constructed sustainable portfolios to their communities, such as through social media. Pebble aims to empower and reward a new climate-conscious generation for raising awareness about climate change.

To learn more about Pebble Finance, watch the company’s presentation at our Understory Showcase here: Understory’s ‘Startups Driving Sustainability’ February 2022 Showcase Event.

[1] Pebble Finance. What is Direct Indexing. 2021.

[2] CNBC. Picking a socially responsible fund. 2022

Join the conversation.